BTC Price Prediction: Bullish Momentum Amid Volatility

#BTC

- BTC is trading below its 20-day MA but shows bullish MACD momentum.

- Market sentiment is mixed, with institutional interest offset by macroeconomic fears.

- Long-term price speculation points to $200K by 2025, driven by adoption and macro trends.

BTC Price Prediction

BTC Technical Analysis: Key Indicators and Future Trends

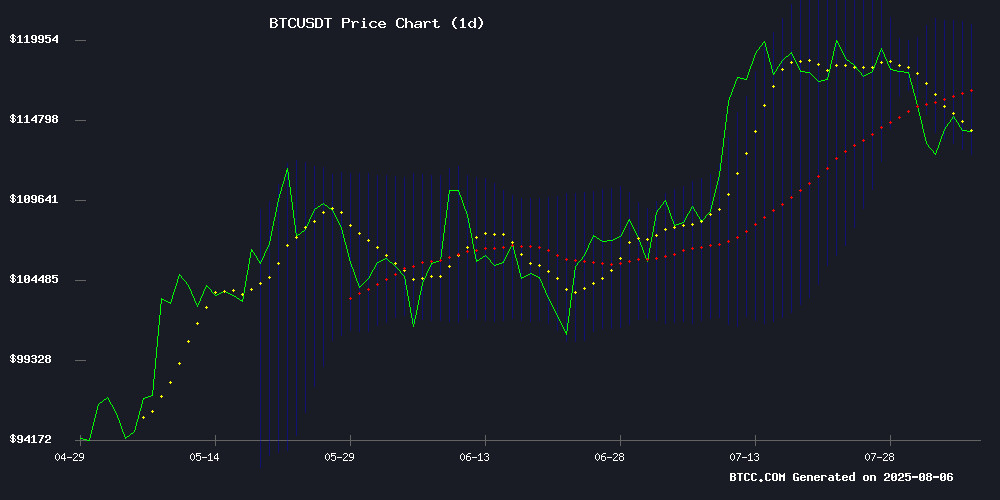

According to BTCC financial analyst Ava, Bitcoin (BTC) is currently trading at 114,047.76 USDT, slightly below its 20-day moving average (MA) of 116,765.73. The MACD indicator shows a bullish crossover with the MACD line at 2,160.96 and the signal line at 469.67, suggesting potential upward momentum. Bollinger Bands indicate a neutral to slightly bearish trend, with the price hovering near the middle band (116,765.73). The upper band at 120,953.37 and the lower band at 112,578.10 could act as resistance and support levels, respectively.

Market Sentiment: Mixed Signals Amid Bitcoin Volatility

BTCC financial analyst Ava highlights the mixed sentiment in the market. On one hand, institutional accumulation and miner growth signal bullish momentum, while on the other, fears of US stagflation and recent liquidations of $343 million weigh on investor confidence. News of Indonesia exploring bitcoin as a reserve asset and Binance Futures hitting a six-month high adds to the volatility. Ava notes that while technical corrections may spark short-term drops, the long-term outlook remains optimistic, with speculation of BTC reaching $200K in 2025.

Factors Influencing BTC’s Price

Bitcoin Faces Potential Downturn After Brief Recovery into Bearish Zone

Bitcoin's price rebounded to $115,000 following a sharp drop to $112,000, as investors locked in profits after July 2025's record highs. The recovery remains fragile, with the cryptocurrency now hovering in a bearish Fair Value Gap (FVG) between $114,000 and $115,500—a zone analysts warn could trigger another sell-off.

Crypto analyst Kamran Asghar highlights this FVG as a critical resistance level, formed after Bitcoin's earlier plunge from $118,000. The area now functions as a supply zone, requiring significant bullish momentum to overcome. Market structure suggests a rejection at this level could catalyze further downside.

UK Police Reap $665K Windfall from Seized Bitcoin's Price Surge

Lancashire Police have turned criminal proceeds into public benefit after confiscated Bitcoin appreciated beyond the original fraud value. The digital assets, seized from criminals who converted stolen fiat into cryptocurrency in 2017, ballooned in value during police custody.

UK restitution laws mandated full compensation for victims at original loss amounts, leaving a £530,000 ($665,000) surplus. This unusual scenario—where seized crypto outperformed the crime's initial scale—allocates half the excess to policing under the Proceeds of Crime Act framework.

"This windfall lets us both make victims whole and fund crime reduction," said Economic Crime Unit Detective Sergeant David Wainwright. The case highlights cryptocurrency's volatility as both an investigative challenge and potential force multiplier for law enforcement budgets.

BitBridge Capital Strategies Finalizes Merger, Aims for Nasdaq Listing with Bitcoin-Centric Strategy

BitBridge Capital Strategies has completed its merger with Green Mountain Merger Inc., setting the stage for its OTC market debut under the ticker BTTL by Q3. The firm plans to uplist to Nasdaq, joining a growing cohort of public companies leveraging bitcoin as a core treasury asset.

The company distinguishes itself by operating exclusively within the Bitcoin economy, with no legacy operations. Its strategy revolves around building long-term Bitcoin reserves and launching financial products aligned with sound money principles, including Respect Loan—a Bitcoin-collateralized lending program designed to mitigate crypto volatility through multi-year terms and low interest rates.

BitBridge will amplify its market presence through a high-profile college football sponsorship and an educational podcast hosted by CEO Paul Jaber. The MOVE underscores institutional confidence in Bitcoin's role as a treasury asset amid expanding crypto adoption.

Cryptocurrency Market Sees $343 Million Liquidation as Bitcoin Dips to $113k

The cryptocurrency market extended its decline, shedding $343 million in liquidations over the past 24 hours as Bitcoin fell to $113,000. The drop marks a reversal from July's rally, with BTC down 0.8% daily and 4% weekly despite maintaining 104% yearly gains.

Federal Reserve rate decisions and weak jobs data—nonfarm payrolls grew just 73,000—triggered the sell-off. Market uncertainty deepened after President TRUMP fired BLS Commissioner Erika McEntarfer and escalated global trade tensions through new tariffs.

US Stagflation Fears Intensify as Bitcoin and Equities Grapple with Fed Policy Dilemma

President Donald Trump's tariff order nears finalization, but a more pressing concern emerges: early stagflation signals in the US industrial sector. The Institute for Supply Management's July services PMI landed at 50.1, missing forecasts of 51.5 and perilously close to contraction territory. While still indicating expansion, the 0.7-point drop from June's 50.8 reveals slowing momentum.

Alarm bells sound as the employment index plunges to 46.4 - its lowest since March - while the price index surges to 69.9, marking October 2022 highs. This toxic cocktail of rising prices amid job cuts presents policymakers with a Gordian knot: inflation demands rate hikes, while economic weakness calls for cuts. The Fed now faces its toughest balancing act since the Volcker era.

Cryptocurrencies, particularly Bitcoin, find themselves caught in the crossfire. As both risk asset and inflation hedge, BTC's next move may hinge on whether markets price in stagflation or anticipate Fed intervention. The coming weeks will test digital assets' resilience against this macroeconomic perfect storm.

Bitcoin Institutional Accumulation and Miner Growth Signal Bullish Momentum

Bitcoin holds steady at $113,906 despite a marginal 0.43% dip, with $58.5 billion in 24-hour trading volume underscoring sustained market interest. Galaxy Digital's strategic pivot shines as it reports a $30.7 million Q2 profit, reversing a $295 million Q1 loss. The firm added 4,272 BTC last quarter—now holding 17,102 BTC ($1.95 billion)—in a move that tightens supply and reinforces long-term price support.

Meanwhile, Chinese miner Cango demonstrates the sector's expansion, producing 650 BTC in July—a 44% monthly increase—after deploying $256 million in Bitmain rigs. Its 32 EH/s hashrate now places it among the top 20 public BTC holders globally, with 4,529.7 BTC ($512 million) in reserves. Infrastructure investments like Galaxy's Helios data center and Cango's operational scaling reflect deepening institutional commitment to Bitcoin's ecosystem.

Binance Futures Volume Hits Six-Month High Amid Bitcoin Volatility

Binance's derivatives trading volume surged to $2.55 trillion in July, marking a six-month high as Bitcoin and altcoin price swings reignited market activity. The exchange accounted for over half of all major platforms' volumes, outpacing rivals Bybit ($929 billion) and OKX ($1.09 trillion).

CryptoQuant analyst J.A. Maartun attributes the spike to renewed trader participation following July's $4 trillion market cap peak and subsequent pullback. Binance's daily derivatives volume peaked at $134 billion on July 18, with 568 trading pairs reinforcing its liquidity dominance.

Indonesia Explores Bitcoin as Reserve Asset to Boost Economy

Indonesia is seriously considering Bitcoin as a national reserve asset, marking a rare governmental exploration of cryptocurrency for economic stability. Officials from the Vice President's office met with Bitcoin Indonesia to discuss integrating Bitcoin into the country's long-term financial strategy.

The proposal includes leveraging Indonesia's abundant geothermal and hydroelectric resources to power Bitcoin mining operations. This dual approach aims to build reserves while promoting renewable energy use. Education programs on Bitcoin and blockchain technology were also emphasized as critical for mainstream adoption.

With a population of 280 million and a $1.4 trillion GDP, Indonesia represents a significant potential adopter among emerging economies. The move could position the country as a leader in cryptocurrency integration at the sovereign level.

Bitcoin’s Technical Correction Sparks $200K Price Speculation for 2025

Bitcoin is navigating a technical correction after briefly setting a new all-time high in July, declining 7.2% from its peak of $123,000 to $113,993. Analysts frame this as a natural consolidation phase within a broader bullish trend.

CryptoQuant’s Oinonen attributes the pullback to macroeconomic uncertainty and Leveraged liquidations, emphasizing its technical nature. The market remains focused on Bitcoin’s price discovery process, which could establish a foundation for Q4 gains.

Despite short-term volatility, the $200K price target for 2025 persists among bullish observers. The asset’s ability to stabilize above $110K may determine whether this correction evolves into a springboard for renewed momentum.

Altseason or Another False Start? Experts Split on Altcoin Market’s Next Move

Market analysts are divided on whether the recent altcoin rally signals the beginning of a sustained altseason or another short-lived surge. Bitcoin's dominance briefly dipped NEAR 60%, a historical precursor to altcoin outperformance, yet Matrixport analyst Markus Thielen warns of structural weaknesses in the altcoin market.

Two fleeting altcoin rallies in Q4 2024 lacked fundamental support, leading to rapid reversals. Current funding rate declines suggest waning enthusiasm, mirroring past patterns. SwissBlock's 'Altcoin Vector' indicates a potential transition phase, but conflicting data leaves investors questioning the durability of capital rotation into higher-risk assets.

Bitcoin Price Wobbles Below Resistance – Could a Fresh Drop Follow?

Bitcoin's price action remains constrained below the $116,200 resistance level, with the cryptocurrency now consolidating within a narrow range. The failure to sustain momentum above $115,500 has left the market vulnerable to further downside, potentially testing the $112,500 support zone.

A bearish trend line is forming on the hourly chart, with resistance firmly established at $114,400. The 100-hour Simple Moving Average continues to act as a dynamic ceiling, reinforcing the near-term bearish bias. Market participants are closely watching the Fib retracement levels, where the 50% level of the recent decline from $118,918 to $112,000 has proven particularly stubborn.

The immediate battleground lies between $114,000 and $115,500. A decisive breakout above this zone could invalidate the current bearish structure, while failure to hold $112,000 may accelerate selling pressure. Liquidity pools beneath recent lows remain a critical factor for institutional traders.

How High Will BTC Price Go?

Based on current technical indicators and market sentiment, BTCC financial analyst Ava predicts that Bitcoin could see a short-term pullback to test support at 112,578.10 USDT. However, the bullish MACD crossover and institutional interest suggest a potential rebound towards 120,953.37 USDT in the near term. Long-term targets remain optimistic, with speculation of BTC reaching $200,000 by 2025, driven by institutional adoption and macroeconomic factors.

| Indicator | Value |

|---|---|

| Current Price | 114,047.76 USDT |

| 20-day MA | 116,765.73 USDT |

| MACD Line | 2,160.96 |

| Signal Line | 469.67 |

| Bollinger Upper Band | 120,953.37 USDT |

| Bollinger Lower Band | 112,578.10 USDT |